Refund Policy

The Center for Employment Training (CET) adheres to both Federal Return of Title IV funds (federal financial aid) and State/Institutional refund policies.

CET will return eligible funds in the following order of priority as applicable:

- Federal: Funds will be returned consistent with the Federal Return of Title IV Policy;

- State/Institutional: Any remaining funds received from other sources of financial aid (e.g. private scholarships, Farmworker funds, etc.) may be returned; and

- Any remaining eligible funds may be disbursed to the student.

Federal Refund Policy

Federal Title IV (financial aid) funds are awarded to a student under the assumption that the student will attend school for the entire period for which the assistance is awarded. When a student withdraws, the student may no longer be eligible for the full amount of Federal Title IV funds that the student was originally scheduled to receive.

Students receiving financial aid funds who withdraw or whose enrollment is terminated by CET at or prior to completing 60% in a Payment Period may be entitled to a return of Federal Title IV funds.

The Federal Return of Title IV funds applies to every student receiving funds from the Pell Grant, SEOG and Direct Loan Programs (includes PLUS Loan). Federal Work Study funds are not subject to the refund provision.

Students need to be aware of the following in regards to the Federal Return of Title IV policy:

- Any student considering withdrawing from their program, should speak to the Financial Aid Officer at their local Center.

- Students entitled to a Federal Return of Title IV, will have federal financial aid funds returned in the following order of priority:

- Federal Unsubsidized Direct Loan

- Federal Subsidized Direct Loan

- Federal Direct PLUS Loan

- Federal Pell Grant

- Federal SEOG Grant

- The last date of attendance determines the cut-off date for federal financial aid fund eligibility.

- A student earns federal financial aid funds based on the number of clock hours scheduled to have been completed in the Payment Period as of the last date of attendance.

- If a withdrawal takes place at or prior to 60% of scheduled hours within a Payment Period, a refund may occur. CET and the student are only entitled to keep federal financial aid based on the percentage of time that was completed. The remainder of the time in the Payment Period is unearned time or unearned federal financial aid.

- If a refund is made to the U.S. Department of Education, it may leave the student with an outstanding balance due to CET.

- An administrative fee of $100 will be assessed for students that withdraw prior to or at 60% of the scheduled program hours.

- No refund will occur for a withdrawal that takes place after 60% of scheduled hours within a Payment Period. CET and the student have earned and are entitled to keep 100% of the financial aid scheduled to be received within the Payment Period.

- CET must return the amount of Federal Title IV funds for which it is responsible no later than 45 days after the date of determination of the student’s withdrawal date.

- All CET sites adhere to their State policy. For details on refunds per State policy, please refer to the Student Catalog or the student’s Enrollment Agreement.

Example Federal Refund Calculation for illustration purposes only –

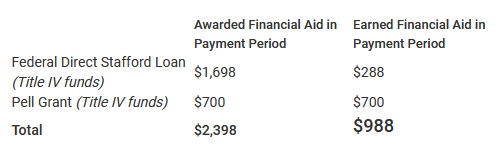

The following is an example of a federal return of funds for a student who withdrew from a 630-hour program with a tuition of $8,996 having completed 130 hours of the scheduled 315 hours in the Payment Period (half of the scheduled program hours). This student would have earned 41.2% of his Federal Financial Aid Funds for the Payment Period (130/315 = 41.2%). The remaining amount would have to be returned to the appropriate source.

1) $1,698 (Loan) + $700 (Pell) = $2,398 Total Federal Title IV funds in Payment Period

2) $2,398 X 41.2% = $988 Earned Federal Title IV funds (Federal Financial Aid)

3) $288 (Loan) + $700 (Pell) = $988 Allowed to keep, earned, per Title IV regulation. Loan has a higher hierarchy therefore, more money would have to be refunded. The Pell grant has a lower hierarchy, so more of the Pell grant would be kept.

4) $2,398 – $988 = $1,410 (Loan) will be refunded to U.S. Department of Education as unearned funds. As established on HEA, Section 484B and 34 CFR 668.22.

- A student who has borrowed from the Federal Direct Loan program must repay the loan(s) according to the terms of the Master Promissory Note (MPN).

- A student’s dissatisfaction with the educational services being offered by CET does not excuse the student from repayment of any Federal Direct Loan made to student.

- Under extreme and special circumstances, a student may be eligible for consideration for a refund approved by the President/CEO.

Students are responsible for any tuition balance due to CET and for meeting their federal financial aid requirements.

The responsibility for returning unearned Federal Title IV funds is shared between CET and the student. Financial aid funds are allocated according to the portion of disbursed aid that was used to cover CET tuition charges, and the portion that was disbursed directly to student once those tuition charges were covered. CET will distribute the unearned federal financial aid funds back to the appropriate Federal Title IV programs, as specified by Federal regulations. Student will be billed for the amount that may be owed for the federal financial aid loan requested, as well as any balance due to CET.

Note: This policy is subject to change at any time without prior notice if necessary to comply with Federal law.

State/Institutional Refund Policy

California

Students have the right to withdraw from a program of instruction at any time. Tuition will be refunded when students withdraw up to completing 60% of the scheduled enrollment period (all hours of the program) and an administrative fee of $100 will be assessed. No tuition will be refunded for any withdrawals that occur after sixty percent (60%) of the scheduled enrollment period.

General Basis for the Refund Calculation

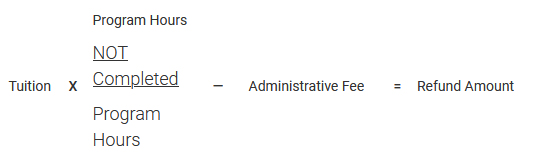

Refunds are calculated as of the day following the last day of attendance using the following formula:

Example:

$8,896 X 500 Hrs. Not Completed ÷ 630 Program Hours – $100 Admin Fee = $6,960 Refund Amount

Texas

Students have the right to withdraw from a course of instruction at any time. Refunds will be paid within 60 days following the determination of the withdrawal date.

Refund Procedures

- Refund computations will be based on scheduled course time of class attendance through the last date of attendance. Leaves of absence, suspensions and school holidays will not be counted as part of the scheduled class attendance.

- The effective date of termination for refund purposes, will be the earliest of the following:

– The last date of attendance, if the student is terminated by the school;

– The date of receipt of written notice from the student; or

– Ten school days following the last date of attendance. - If tuition and fees are collected in advance of entrance, and if after expiration of the 10-day cancellation period, the student does not enter the school, not more than $100 in any nonrefundable administrative fees charged shall be retained by the school for the entire residence program or synchronous distance education course.

- If a student enters a residence or synchronous distance education program and withdraws or is otherwise terminated, after the cancellation period, the school or college may retain not more than $100 in any administrative fees charged for the entire program. The minimum refund of the remaining tuition and fees will be the pro rata portion of tuition, fees, and other charges that the number of hours remaining in the portion of the course or program for which the student has been charged after the effective date of termination bears to the total number of hours in the portion of the course or program for which the student has been charged, except that a student may not collect a refund if the student has completed 75% or more of the total number of hours in the portion of the program for which the student has been charged on the effective date of termination. (More simply, the refund is based on the precise number of course or program hours the student has paid for, but not yet used, at the point of termination, up to the 75% completion mark, after which no refund is due.)

- Refunds for items of extra expense to the student, such as books, tools, or other supplies are to be handled separately from refund of tuition and other academic fees. The student will not be required to purchase instructional supplies, books and tools until such time as these materials are required. Once these materials are purchased, no refund will be made. For full refunds, the school can withhold costs for these types of items from the refund as long as they were necessary for the portion of the program attended and separately stated in the enrollment agreement. Any such items not required for the portion of the program attended must be included in the refund.

- A student who withdraws for a reason unrelated to the student’s academic status after the 75% completion mark and requests a grade at the time of withdrawal shall be given a grade of “incomplete” and permitted to re-enroll in the course or program during the 12-month period following the date the student withdrew without payment of additional tuition for that portion of the course or program.

- A full refund of all tuition and fees is due and refundable in each of the following cases:

(a) An enrollee is not accepted by the school;

(b) If the course of instruction is discontinued by the school and this prevents the student from completing the course; or

(c) If the student’s enrollment was procured as a result of any misrepresentation in advertising, promotional materials of the school, or representations by the owner or representatives of the school. A full or partial refund may also be due in other circumstances of program deficiencies or violations of requirements for career schools and colleges. - Refund Policy for Students Called to Active Military Service

A student of the school or college who withdraws from the school or college as a result of the student being called to active duty in a military service of the United States or the Texas National Guard may elect one of the following options for each program in which the student is enrolled:(a) If tuition and fees are collected in advance of the withdrawal, a pro rata refund of any tuition, fees, or other charges paid by the student for the program and a cancellation of any unpaid tuition, fees, or other charges owed by the student for the portion of the program the student does not complete following withdrawal;

(b) A grade of incomplete with the designation “withdrawn-military” for the courses in the program, other than courses for which the student has previously received a grade on the student’s transcript, and the right to re-enroll in the program , or a substantially equivalent program if that program is no longer available, not later than the first anniversary or the date the student is discharged from active military duty without payment of additional tuition, fees, or other charges for the program other than any previously unpaid balance of the original tuition, fees, and charges for books for the program; or

(c) The assignment of an appropriate final grade or credit for the courses in the program, but only if the instructor or instructors of the program determine that the student has:

(1) Satisfactorily completed at least 90 percent of the required coursework for the program; and

(2) Demonstrated sufficient mastery of the program material to receive credit for completing the program.

- The payment of refunds will be totally completed such that the refund instrument has been negotiated or credited into the proper account(s), within 60 days after the effective date of termination.

Virginia

Tuition will be refunded when students withdraw prior to completing 75% of the scheduled course hours and an administrative fee of $100 or 15% of the course tuition, whichever is less, will be assessed. No tuition will be refunded for any withdrawals that occur after seventy-five (75%) of the scheduled course hours. The minimum refund policy for a school that financially obligates the student for the entire amount of tuition and fees for the entirety of a program or course shall be as follows:

- a) A student who enters the school but withdraws or is terminated during the first quartile (25%) of the program shall be entitled to a minimum refund amounting to 75% of the cost of the program.

- b) A students who withdraws or is terminated during the second quartile (more than 25% but less than 50%) of the program shall be entitled to a minimum refund amounting to 50% of the cost of the program.

- c) A student who withdraws or is terminated during the third quartile (more than 50% but less than 75%) of the program shall be entitled to a minimum refund amounting to 25% of the cost of the program.

- d) A student who withdraws after completing more than three quartiles (75%) of the program shall not be entitled to a refund.